Business CD Account: Complete Guide to Certificate of Deposit Banking for Companies

Understand business certificate of deposit accounts

A business certificate of deposit (CD) account represent a specialized time deposit product design specifically for companies, corporations, and business entities. Unlike traditional savings accounts, business CDs require funds to remain deposited for a predetermine period, typically range from three months to five years, in exchange for guarantee returns at fix interest rates.

Business CDs function as low risk investment vehicles that help companies preserve capital while earn predictable returns. Banks and credit unions offer these products to business customers seek secure parking spots for excess cash flow, emergency funds, or money earmark for future projects.

How business CDs differ from personal CDs

Several key distinctions separate business CDs from their personal counterparts. Business CDs typically require higher minimum deposits, much start at $1,000 to $$10000, compare to personal cdCDshat may have lower entry points. The higher minimums reflect the larger cash reserves businesses typically maintain.

Interest rates on business CDs may vary from personal CD rates, sometimes offer competitive advantages for larger deposits. Banks recognize that business customers oftentimes deposit substantial amounts, lead to preferential pricing structures. Additionally, business CDs may offer more flexible terms and maturity options tailor to corporate cash flow cycles.

Tax implications to differ importantly. Personal cCDinterest gets report on individual tax returns, while business cCDearnings become part of corporate income subject to business tax rates and regulations. This distinction affect how companies integrate cCDinvestments into their overall financial strategies.

Types of business CD accounts

Traditional fix rate business CDs offer guarantee interest rates throughout the entire term. These products provide predictable returns, make them ideal for conservative cash management strategies. Companies can calculate exact earnings at the time of deposit, facilitate accurate financial planning.

Variable rate business CDs adjust interest payments base on market conditions or benchmark rates. While these products carry more uncertainty, they potentially offer higher returns during rise interest rate environments. Businesses comfortable with modest risk may find variable rate CDs attractive.

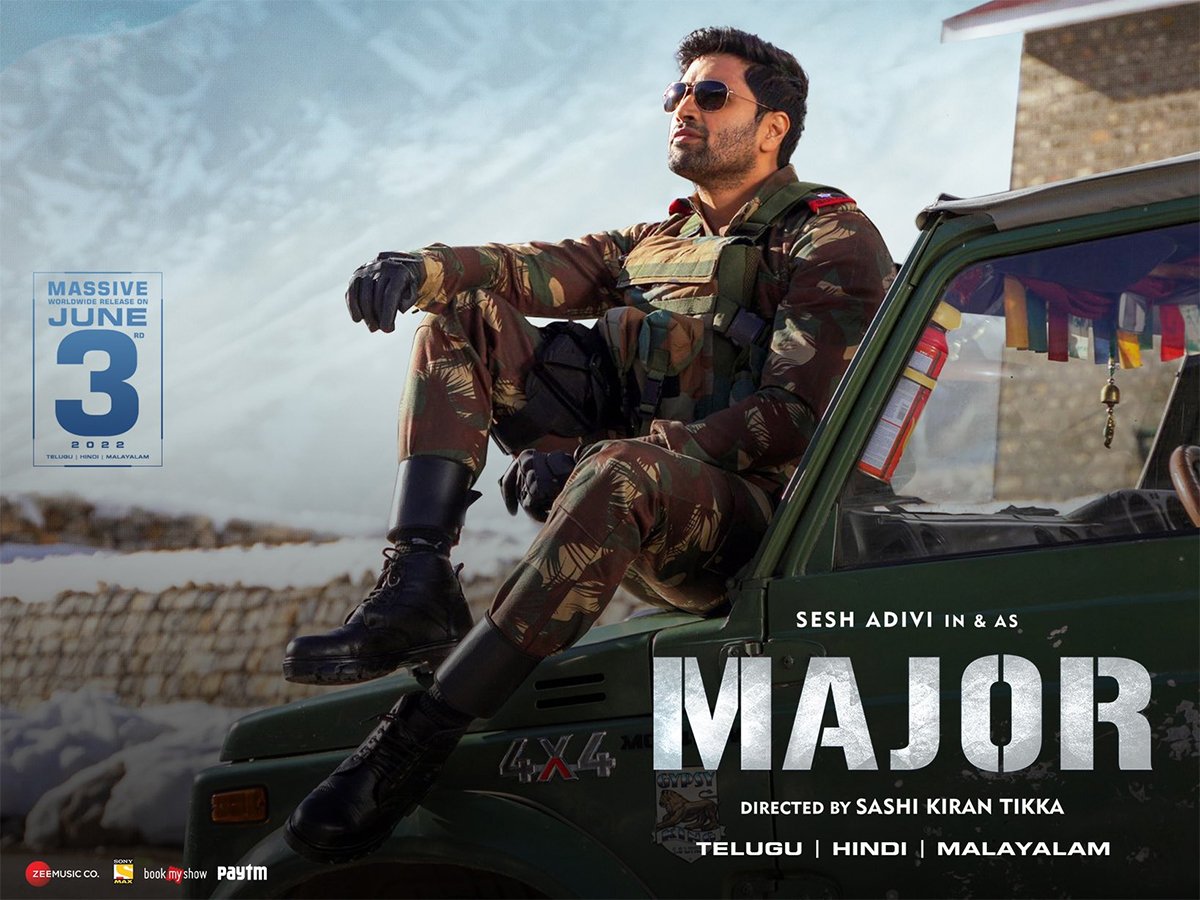

Source: kristinswisdom.com

Callable CDs give banks the right to terminate the CD before maturity, typically when interest rates decline. These products oftentimes offer higher initial rates to compensate for the call risk. Businesses must evaluate whether the premium rates justify the potential for early termination.

Step up CDs feature interest rates that increase at predetermine intervals throughout the term. These products appeal to businesses expect rise interest rates, as they provide some protection against rate increases without require new deposits.

Benefits of business CD accounts

Capital preservation rank among the primary advantages of business CDs. Unlike stocks, bonds, or other investments subject to market volatility, CDs provide principal protection back by FDIC insurance up to applicable limits. This security make CDs valuable for emergency funds or money need for specific future purposes.

Predictable returns enable accurate financial forecasting. Businesses can calculate exact CD earnings when make deposits, allow for precise budget planning and cash flow projections. This certainty prove specially valuable for companies with seasonal revenue patterns or plan capital expenditures.

Diversification benefits emerge when CDs complement other business investments. While CDs typically offer lower returns than growth investments, they provide stability that balance riskier portfolio components. This balance help smooth overall investment performance.

Liquidity laddering strategies become possible with multiple CDs having stagger maturity dates. Businesses can structure CD portfolios to provide regular access to funds while maintain continuous investment exposure. This approach combine the benefits of longer term rates with periodic liquidity opportunities.

Potential drawbacks and considerations

Interest rate risk affect CD investments when rates rise after deposit. Money lock in lower rate CDs can not take advantage of improved market conditions without pay early withdrawal penalties. This opportunity cost can be significant during periods of quickly rise rates.

Early withdrawal penalties typically range from several months to a full year of interest, depend on the CD term. These penalties can eliminate earn interest and potentially reduce principal if withdrawals occur former in the CD term. Businesses must cautiously evaluate their liquidity needs before commit funds.

Inflation risk threaten the purchase power of CD returns. When inflation exceed CD interest rates, the real value of invest funds declines over time. This erosion can be specially problematic for longer term CDs during inflationary periods.

Limited liquidity restrict access to deposit funds without penalty. Unlike savings accounts or money market accounts, CDs tie up money for specific periods. Businesses must ensure adequate liquid reserves remain available for unexpected opportunities or emergencies.

Choose the right business CD

Term selection depend on business cash flow patterns and interest rate expectations. Shorter terms provide more flexibility and quicker access to funds but typically offer lower rates. Longer terms broadly provide higher returns but reduce flexibility and increase interest rate risk.

Minimum deposit requirements vary importantly among financial institutions. While higher minimums may qualify for better rates, businesses should avoid tie up excessive funds in single CDs. Diversify across multiple CDs or institutions can provide better risk management.

Financial institution selection involve evaluate factors beyond interest rates. Bank stability, customer service quality, online banking capabilities, and additional business services should influence decisions. Credit unions may offer competitive rates but with membership requirements.

Rate shopping across multiple institutions oftentimes reveal significant differences in CD offerings. Online banks often provide higher rates than traditional brick and mortar institutions due to lower overhead costs. Nonetheless, businesses should verify that online banks provide adequate customer service and account management tools.

FDIC insurance and safety considerations

FDIC insurance protect business CD deposits up to $250,000 per depositor, per insured bank, for each account ownership category. Businesses with larger amounts should spread deposits across multiple institutions to maximize insurance coverage. This strategy, know as deposit diversification, ensure complete principal protection.

Credit union deposits receive similar protection through the national credit union administration (nNCAA)insurance fund. The coverage limits and structure mirror fdFDICrotection, provide equivalent safety for business deposits in qualified credit unions.

Bank financial health deserve consideration flush with insurance protection. While FDIC insurance guarantee principal and accrued interest, bank failures can create temporary access delays and administrative complications. Research bank ratings and financial stability help avoid potential disruptions.

Strategic uses for business CDs

Emergency fund management represent a common CD application. Businesses can ladder CDs to create roll emergency reserves that earn higher returns than traditional savings accounts while maintain reasonable access to funds. This strategy balance earn potential with liquidity needs.

Tax payment reserves benefit from CD investments when businesses set aside money for quarterly estimate taxes or annual tax obligations. The predictable maturity dates can align with tax payment schedules, ensure funds availability while earn returns during the hold period.

Equipment replacement funds work wellspring with CD investments when businesses plan future capital expenditures. Companies can calculate equipment replacement costs and invest appropriate amounts in CDs mature near plan purchase dates. This approach ensure fund availability while generate returns.

Seasonal cash flow management become easier with strategically time CDs. Businesses with seasonal revenue patterns can invest excess funds during peak periods in CDs mature before cash flow typically tightens. This timing maximizes earn potential while ensure liquidity whenneededd.

Alternatives to business CDs

Business money market accounts provide higher liquidity than CDs while oftentimes offer competitive interest rates. These accounts typically allow limited monthly transactions and may require higher minimum balances. The trade-off involve somewhat lower rates in exchange for greater flexibility.

Treasury securities offer government back safety with various maturity options. Treasury bills, notes, and bonds provide alternatives to CDs with potentially different tax treatments and liquidity characteristics. Businesses should compare treasury yields to CD rates when make investment decisions.

High yield business savings accounts deliver immediate liquidity with competitive interest rates. While rates may fluctuate with market conditions, these accounts provide complete flexibility for deposits and withdrawals. They work advantageously for short term cash management need.

Commercial paper and short term corporate bonds offer potentially higher returns for businesses comfortable with additional credit risk. These investments require more sophisticated analysis but may provide superior returns for companies with appropriate risk tolerance and investment expertise.

Make the most of business CD investments

Regular rate monitoring help businesses optimize their CD strategies. Interest rates change oftentimes, and stay inform about current offerings enable better timing decisions for new investments and rollovers. Many banks offer rate alerts to help customers track changes.

Automatic renewal features require careful attention. Many CDs mechanically renew at maturity unless customers provide specific instructions. While convenient, automatic renewal may lock funds into unfavorable rates. Businesses should calendar maturity dates and actively manage renewal decisions.

Professional financial advice become valuable for businesses with substantial CD investments or complex cash management needs. Financial advisors can help optimize CD strategies within broader investment portfolios and ensure alignment with business financial goals.

Documentation and record keep support tax preparation and financial reporting requirements. Businesses should maintain detailed records of CD investments, include purchase dates, terms, interest rates, and maturity information. This documentation simplifies accounting and tax compliance processes.

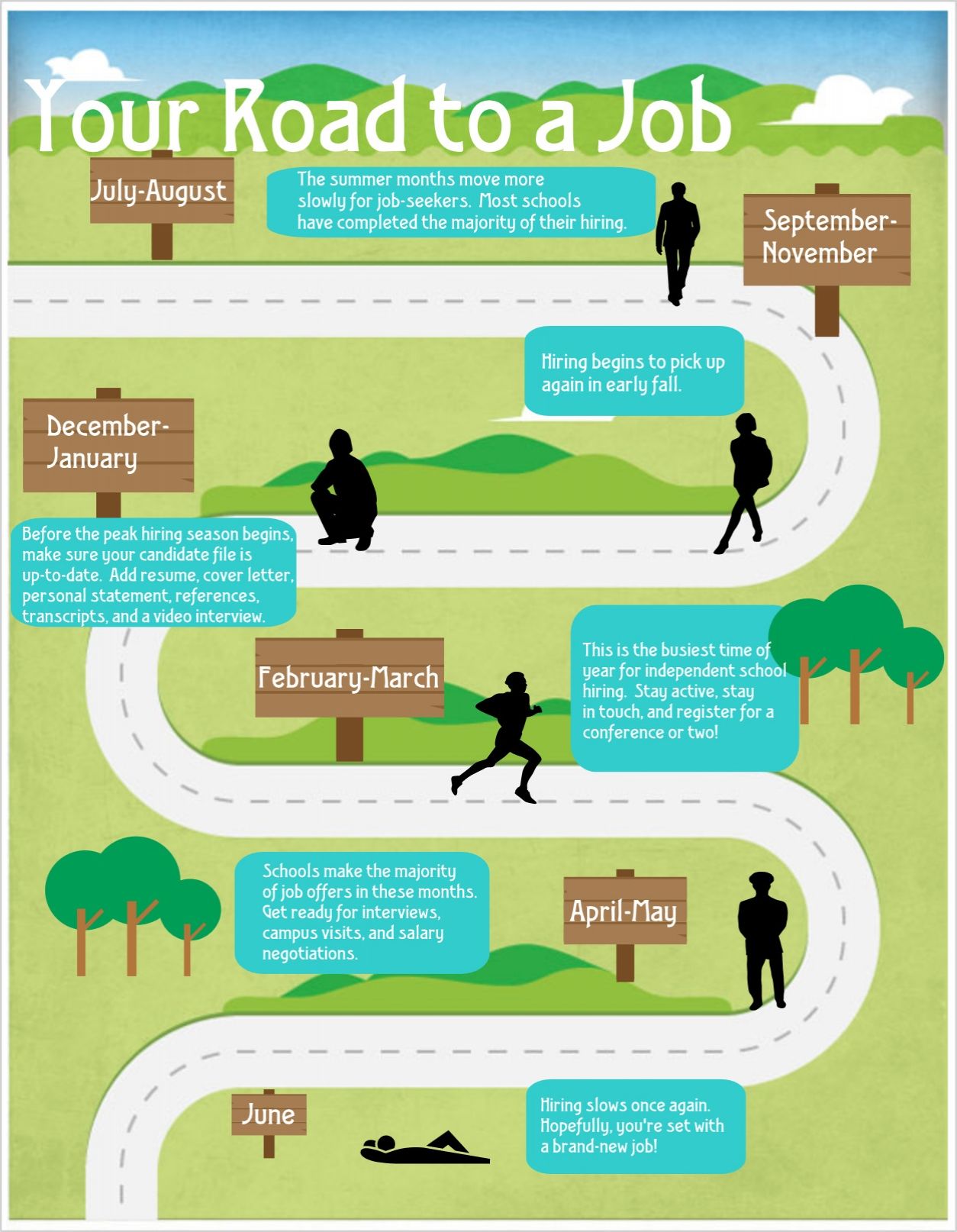

Source: finserving.com

MORE FROM grabjobtoday.com