Do You Need a Business License in California? Complete Guide for New and Existing Businesses

Understanding Business Licensing in California

Starting a business in California is an exciting endeavor, but one of the first and most important questions you need to answer is whether you need a business license to operate legally. This guide provides clear, actionable information for entrepreneurs, freelancers, and small business owners on how to navigate California’s business licensing requirements, including state, local, and industry-specific rules. We’ll also cover practical steps for applying, compliance tips, and alternatives for unique situations.

Is a Business License Required in California?

Unlike some other states, California does

not

require or issue a universal, statewide business operating license. This means you are not automatically required to obtain a general state-issued business license simply for operating a business. However, nearly every city and county in California

does

require a local business license or business tax certificate to operate legally within their jurisdiction. In addition, certain industries require state or federal occupational licenses or permits based on the type of services provided

[1]

,

[3]

.

Types of Business Licenses and Permits in California

California’s business licensing is managed at three main levels:

- Local (City/County) Licenses: Most cities and counties require a general business license or business tax certificate. This applies to both physical business locations and home-based businesses. If you operate in multiple cities, you may need separate licenses for each jurisdiction [2] .

- State Occupational Licenses: Certain professions-such as real estate agents, contractors, accountants, and cosmetologists-require licenses from specific California state agencies. Use the California Department of Consumer Affairs or the Professional Licensure Guide to check your profession’s requirements [1] .

- Federal Licenses: Some business activities, such as selling alcohol, firearms, or operating in transportation, require federal licenses or permits. Refer to the appropriate federal agency for details [3] .

How to Determine Your Licensing Requirements

To identify the specific licenses and permits you need:

- Check Local Regulations: Contact your city or county clerk’s office or visit their official website. Most cities and counties have a business licensing division under the Office of Business and Economic Development [4] .

- Industry-Specific Rules: Review your industry’s regulatory body. For example, health-related businesses may need public health operating permits, while retail businesses require seller’s permits from the California Department of Tax and Fee Administration.

- Home-Based Businesses: Running a business from home often requires a Home Occupation Permit, which ensures compliance with zoning laws and may place limits on employees or customer visits [2] .

- Professional Licenses and Certifications: If your business provides professional services, verify whether you need a state-issued license or certification. The California Professional Licensure Guide and Department of Consumer Affairs provide searchable lists by occupation [1] .

Step-By-Step: Applying for a Business License in California

Once you have identified the required licenses and permits, follow these steps to apply:

- Register Your Business Name: Check name availability on the California Secretary of State’s website. If you plan to operate under a name different from your legal entity, file a “Doing Business As” (DBA) with your county.

- Gather Required Information: Typical application forms will ask for: Social Security Number or EIN, business address, type of business, legal and DBA names, owner contact info, number of employees, estimated annual sales, and NAICS code. Some industries may require proof of professional certification or permits [3] .

- Submit Application: Most local offices offer online, mail, or in-person submission. Fees vary by city, county, and business type, with most ranging from $50 to several hundred dollars. You may also need to register for a seller’s permit if selling tangible goods.

- Post Your License: Once received, post your business license at your location as required for public-facing businesses. Retain digital and physical copies for your records.

- Renew Annually: Most business licenses require annual renewal. Watch for renewal notices and comply promptly to avoid penalties. Renewal fees and requirements can differ by jurisdiction [2] .

Practical Example: Retail Store in Los Angeles

Suppose you want to open a retail store in Los Angeles. You would:

- Contact the Los Angeles Office of Finance for a business tax registration certificate (business license).

- Register your business with the California Secretary of State (for LLCs, Corporations, etc.).

- Apply for a seller’s permit from the California Department of Tax and Fee Administration to collect sales tax.

- Obtain any additional permits required (e.g., signage, fire department inspection).

- Renew your licenses annually and keep all records updated.

Special Cases and Alternative Pathways

Operating in Multiple Locations: If your business has sites in different cities or counties, you may need to obtain separate local licenses or certificates for each location [2] .

Unincorporated Areas: Some unincorporated county areas may not require a business license, but you should always verify with the relevant county office to ensure compliance.

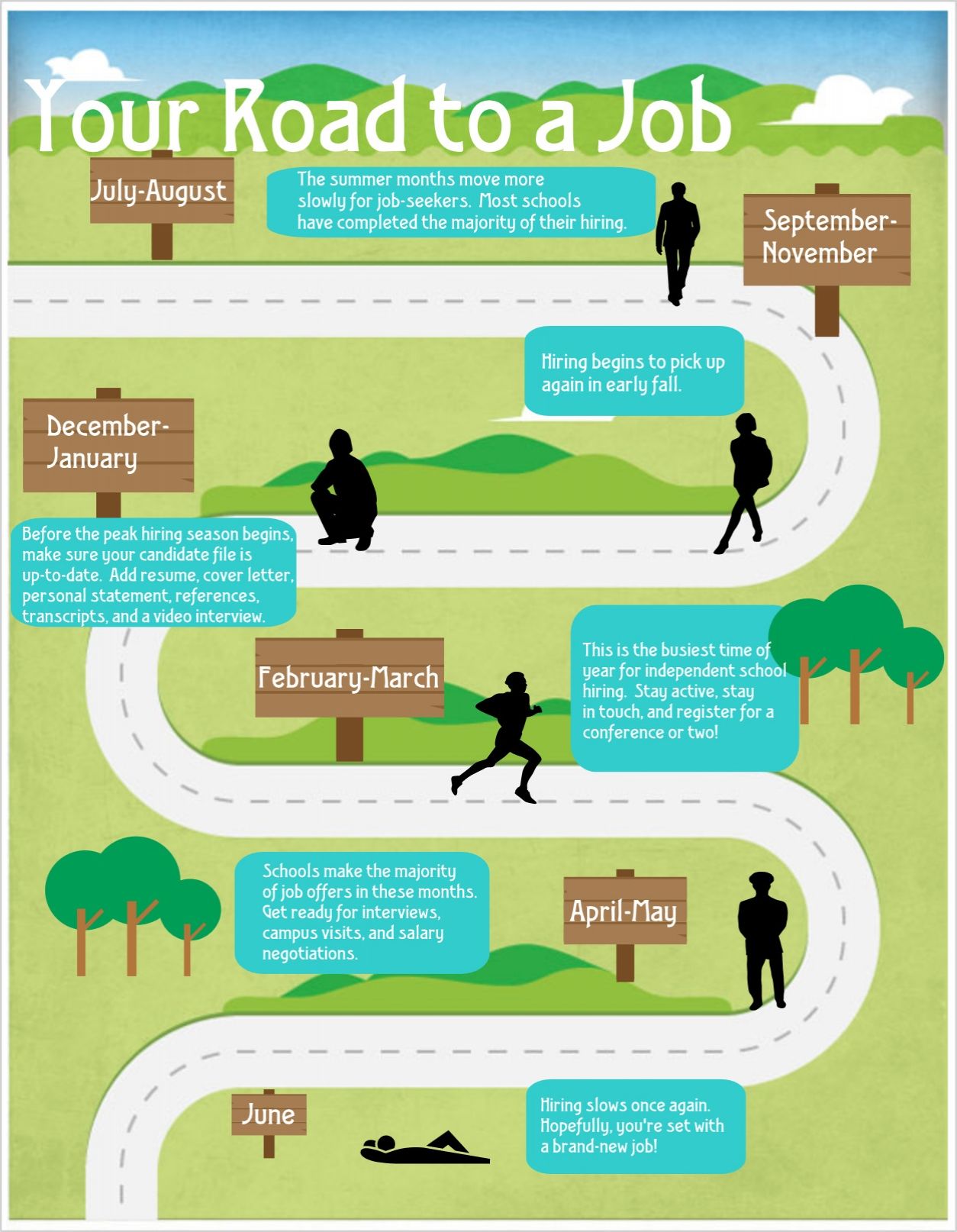

Source: techcrunch.com

Non-Profits and Certain Home-Based Businesses: Some non-profits and very small home-based businesses may qualify for license exemptions or reduced fees. Check with your local jurisdiction for details.

Potential Challenges and Solutions

Common challenges include navigating overlapping regulations, understanding which permits are required for mixed-use businesses, and staying compliant with renewal deadlines. Solutions include:

- Contacting your local Small Business Development Center (SBDC) for free counseling and guidance.

- Consulting the California Office of the Small Business Advocate for up-to-date information and resources.

- Hiring a professional business attorney or compliance consultant for complex situations.

Where to Find Reliable Help and Resources

If you are uncertain about your requirements, you can:

Source: laughingsquid.com

- Call your city or county’s business licensing office for personalized assistance.

- Visit the California Office of the Small Business Advocate website for comprehensive guides and support.

- Use the Professional Licensure Guide on CA.gov to identify state-regulated professions.

- Seek out your local SBDC for in-person workshops and expert advice.

For most official forms and instructions, search for your city or county’s official government website and use terms like “business license application” or “business tax certificate.” Never rely on unofficial sources or third-party websites unless verified as reputable and current.

Key Takeaways

In summary, while California does not require a universal state business license, nearly all businesses must secure local licenses, and many industries require state or federal permits. Always verify requirements for your specific business type and location. Stay proactive about renewals and compliance to avoid penalties. When in doubt, reach out to official agencies for guidance.

References

MORE FROM grabjobtoday.com