Canada Investment Visa Programs: Complete Cost Breakdown and Requirements

Understand Canada’s investment immigration options and costs

Canada offers several pathways for business investors and entrepreneurs look to immigrate through financial investment. Each program have specific investment requirements, additional fees, and eligibility criteria. This comprehensive guide break down incisively how lots you need to invest for each Canadian investment immigration option.

The start-up visa program

The start-up visa program target innovative entrepreneurs who can create jobs for Canadians and compete globally.

Investment requirements

Unlike traditional investor programs, the start-up visa doesn’t have a fix minimum investment amount. Alternatively, you need:

- A qualifying business

- Support from a designate organization (angel investor group, venture capital fund, or business incubator )

- Proof of settlement funds

Designated organization investment thresholds

- Venture capital funds: Minimum investment of $200,000 cad

- Angel investor groups: Minimum investment of $75,000 cad

- Business incubators: No specific investment amount, but require acceptance into their program (typically $$20000 $100,000 cad in program fees ))

Settlement funds

Beyond the business investment, you must show you have enough money to support yourself and your family:

- Single applicant: $13,757 cad

- Family of 2: $17,123 cad

- Family of 3: $21,057 cad

- Family of 4: $25,564 cad

- Each additional family member: + $3,447 cad

These settlement fund amounts are update yearly.

Process fees

- Principal applicant: $1,575 cad

- Spouse / partner: $825 cad

- Each dependent child: $225 cad

- Biometrics fee: $85 cad per person

Provincial nominee programs (pPNP) siness streams

Many Canadian provinces offer business immigration streams under their provincial nominee programs. Investment requirements vary importantly by province.

British Columbia entrepreneur immigration stream

- Minimum net worth: $600,000 cad

- Minimum investment: $200,000 cad

- Job creation: At least one full-time job for a Canadian citizen or permanent resident

- Application fee: $3,500 cad

Ontario entrepreneur stream

- Minimum net worth: $800,000 cad ((tGTA)r $ 4$4000 cad ( ex(rnal gta )GTA)

- Minimum investment: $600,000 cad ((tGTA)r $ 2$2000 cad ( ex(rnal gta )GTA)

- Job creation: 2 permanent full-time jobs

- Application fee: $3,500 cad

Manitoba business investor stream

- Minimum net worth: $500,000 cad

- Minimum investment: $250,000 cad ((iWinnipeg)r $ 1$1500 cad ( ou(ide winniWinnipeg)

- Deposit requirement: $100,000 cad ((efundable upon meeting business requirements ))

- Application fee: $2,500 cad

Saskatchewan entrepreneur program

- Minimum net worth: $500,000 cad

- Minimum investment: $300,000 cad ((eRegina saSaskatoon)r $ 2$2000 cad ( sm(ler communities ) )

- Good faith deposit: $100,000 cad ((efundable ))

- Application fee: $2,500 cad

Nova Scotia entrepreneur stream

- Minimum net worth: $600,000 cad

- Minimum investment: $150,000 cad

- Application fee: $2,150 cad

Prince Edward Island business impact category

- Minimum net worth: $600,000 cad

- Minimum investment: $150,000 cad

- Deposit requirement: $200,000 cad ((efundable ))

- Application fee: $10,000 cad

Self-employed persons program

This program is design for individuals with relevant experience in cultural activities, athletics, or farm management who intend to be self employ in Canada.

Investment requirements

There be no specific minimum investment amount, but applicants must:

Source: businessimmigrationvisas.com

- Have relevant experience in cultural activities, athletics, or farm management

- Intend and be able to become self employ in Canada

- Make a significant contribution to cultural activities, athletics, or farm management in Canada

Process fees

- Principal applicant: $1,575 cad

- Spouse / partner: $825 cad

- Each dependent child: $225 cad

- Biometrics fee: $85 cad per person

Additional costs to consider

Business plan development

Professional business plan preparation can cost between $1,500 $6,000 cad depend on complexity.

Legal and immigration consultant fees

- Immigration lawyer fees: $10,000 $25,000 cad

- Business incorporation: $1,500 $3,000 cad

- Legal review of business purchase: $3,000 $10,000 cad

Business establishment costs

- Market research: $2,000 $10,000 cad

- Business registration: $200 $500 cad

- Office / retail space: varies by location ($$20$60 per square foot yearly in major cities ))

- Equipment and inventory: varies by business type

Relocation expenses

- Move household goods: $5,000 $15,000 cad

- Temporary accommodation: $3,000 $6,000 cad

- Initial housing costs (rent deposits, basic furnishings ) $ $500 $20,000 cad

The former federal investor program

The federal immigrant investor program was terminated in 2014. This programrequirese:

- Minimum net worth of $1.6 million cad

- Investment of $800,000 cad as an interest free loan to the cCanadiangovernment for five years

Despite occasional rumors, there be no current plans to revive this program.

Quebec immigrant investor program (qquip)

The Quebec immigrant investor program has been suspended sincNovemberer 2019. When operational, irequiresre:

- Minimum net worth of $2 million cad

- Investment of $1.2 million cad for five years

- Management experience

Quebec sporadically reviews its immigration programs, so investors should monitor for potential reopening.

Compare investment visa costs across countries

How does Canada compare to other popular investment immigration destinations?

United States (ebe5 program )

- Minimum investment: $800,000 uUSDin targeted employment areas or $$1050,000 usUSDn other areas

- Job creation requirement: 10 full-time jobs

United Kingdom (innovator visa )

- Minimum investment: £50,000 gGBP((oughly $ $8500 cad ) )

- Require endorsement from an approval body

Australia (business innovation and investment program )

- Business innovation stream: AUD $1.25 million ((oughly $ $15 million cad ) )

- Investor stream: AUD $2.5 million ((oughly $ $2 million cad ) )

New Zealand (investor visa )

- Investor 1 category: NZD $10 million ((oughly $ $8 million cad ) )

- Investor 2 category: NZD $3 million ((oughly $ $25 million cad ) )

Return on investment considerations

When evaluate the cost of Canadian investment visas, consider potential returns:

Business growth potential

Canada’s stable economy offer strong potential for business growth. The country rank 23rd on the World Bank’s ease of doing business index and have free trade agreements with 51 countries, provide access to well-nigh 1.5 billion consumers.

Quality of life benefits

Beyond financial returns, Canada systematically rank among the top countries for quality of life, offering:

- Universal healthcare system

- High quality public education

- Political stability and safety

- Clean environment and abundant natural resources

Education and future opportunities

Canadian permanent residency provide access to subsidized education at world-class universities, with average annual tuition for international students at $30,000 cad versus $$7000 cad for permanent residents.

Select the right investment visa program

When decide which Canadian investment immigration pathway fit your situation:

Consider your business background

If you have an innovative business idea but limited capital, thstart-upup visa may be appropriate. Establish entrepreneurs with significant capital might prefer provincial programs.

Source: Canada immigration. Lawyer

Evaluate regional preferences

Different provinces offer vary investment thresholds. Urban centers typically require higher investments than rural areas. Consider:

- Market opportunities for your business

- Industry concentrations

- Climate preferences

- Proximity to international airports

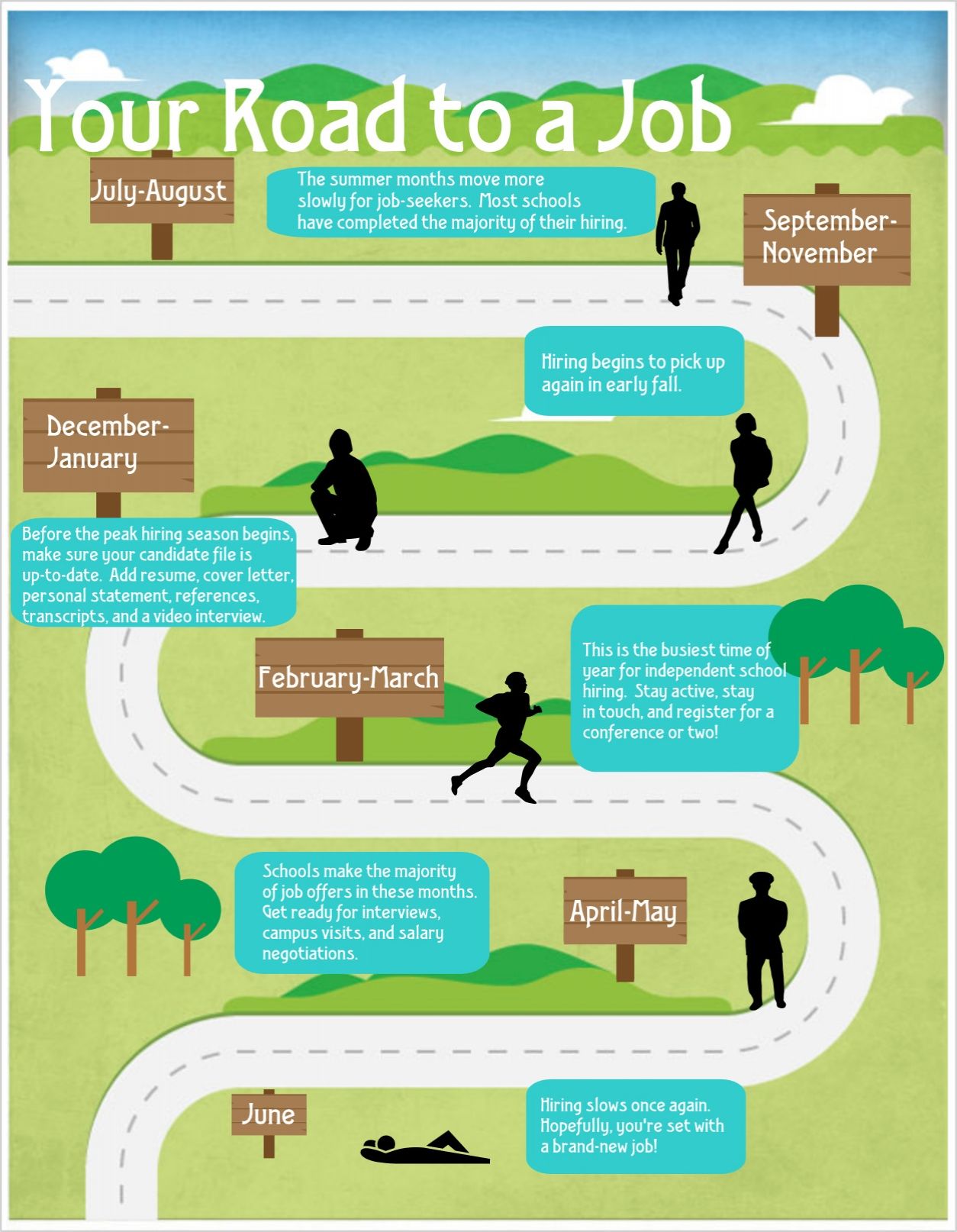

Timeline considerations

Processing times vary importantly:

- Start up visa: 12 16 months

- Provincial programs: 18 24 months (include initial nomination and federal application )

- Self-employed program: 22 26 months

Work with immigration professionals

Give the significant investment and complex requirements, most investors work with:

- Immigration lawyers or consultants (ensure they’re register with the immigration consultants of cCanadaregulatory council )

- Business advisors familiar with Canadian markets

- Tax planners to optimize international tax situations

Professional fees typically range from $15,000 to $$30000 cad but can save substantial amounts by avoid costly mistakes.

Final considerations before investing

Due diligence on business opportunities

Whether start a new business or purchase an exist one, thorough market research is essential. The Canadian government doesn’t guarantee business success, and your permanent residency may depend on business performance.

Language requirements

Most business immigration programs require basic English or French proficiency. Language training costs should be factored into your budgeif neededf need.

Tax implications

Consult with tax experts about:

- Canadian tax residency requirements

- International tax treaties

- Asset report obligations

- Exit tax considerations from your home country

Conclusion

Canada’s investment immigration programs require significant financial commitment beyond the initial investment. Depend on the choose pathway, total costs typically range from $250,000 cad to over $$1million cad, plus additional business establishment expenses.

The near affordable option is presently the start-up visa program, particularly through business incubator streams. Provincial programs offer a middle ground with investment requirements typically between $200,000 $600,000 cad.

While substantial, these investments provide access to Canada’s stable economy, high quality of life, and pathway to citizenship. For entrepreneurs with the necessary capital and business experience, Canadian investment immigration represent a strategic opportunity to expand business horizons while secure permanent residency in one of the world’s about welcoming nations.

MORE FROM grabjobtoday.com