Life Insurance Career: Complete Guide to Building Success in the Industry

Understand the life insurance career landscape

Life insurance represent one of the well-nigh stable and potentially lucrative career paths in the financial services industry. With Americans hold over $20 trillion in life insurance coverage, the demand for qualified agents continue to grow as families recognize the importance of financial protection.

The career attract professionals from diverse backgrounds, offer flexibility, unlimited earn potential, and the satisfaction of help families secure their financial future. Nevertheless, success require dedication, strong interpersonal skills, and a genuine commitment to serve clients’ needs.

Income potential and compensation structure

Life insurance agents typically earn through commission base compensation, though some companies offer salary plus commission structures for new agents. First year commissions range from 40 % to 110 % of the annual premium, with renewal commissions continue for years after.

Entry level agents much earn $30,000 to $$50000 yearly while build their client base. Experienced agents often earn six figure incomes, with top performers reach $ $20000 to $ 5$5000 or more. The key lie in build a sustainable book of business through consistent prospecting and client service.

Many successful agents supplement their income through cross-sell additional products like annuities, disability insurance, and investment products. This diversification creates multiple revenue streams and strengthen client relationships.

Career paths and advancement opportunities

The life insurance industry offer various career trajectories beyond traditional sales roles. Field agents can advance to management positions, oversee teams of agents and earn override commissions on their production.

Corporate opportunities include underwriting, claims processing, actuarial work, and marketing roles. Many agents transition into financial planning, leverage their insurance expertise to provide comprehensive financial advice.

Entrepreneurial agents oftentimes establish their own agencies, build teams and create passive income through recruitment and training. This path requires strong leadership skills and business acumen but offer the highest earn potential.

Essential skills for success

Successful life insurance professionals possess strong communication skills, enable them to explain complex products in understandable terms. Active listening helps identify client needs and concerns, lead to more appropriate product recommendations.

Source: autopril.com

Persistence prove crucial, as sales cycles can be lengthy and rejection is common. Top agents maintain consistent prospect activities and follow-up systems, understand that success come from numbers and persistence.

Financial literacy and product knowledge are fundamental. Agents must understand various policy types, underwriting guidelines, and tax implications to serve clients efficaciously and maintain professional credibility.

Licensing and educational requirements

All life insurance agents must obtain state licensing, which involve complete pre licensing education and pass a state examination. Requirements vary by state but typically include 20 40 hours of coursework cover insurance principles, state regulations, and ethics.

Continue education maintain licensing, with most states require 15 30 hours of approve courses every two years. Many agents pursue additional certifications like chartered life underwriter (cCLU)or certified financial planner ( (pCFP) enhance their expertise and credibility.

While a college degree isn’t invariably require, it’s progressively preferred by major carriers and can accelerate career advancement. Degrees in business, finance, or marketing provide valuable foundations for insurance careers.

Industry challenges and considerations

The life insurance industry face several challenges that potential agents should understand. Commission base income create financial uncertainty, specially during the first year when build a client base.

Regulatory compliance require ongoing attention, as violations can result in license suspension or revocation. Agents must stay current with change regulations and maintain detailed records of client interactions and recommendations.

Market saturation in some areas create intense competition, make prospect more challenging. Successful agents differentiate themselves through specialization, superior service, or unique marketing approaches.

Technology’s impact on the industry

Digital transformation is reshaped how life insurance is sell and service. Online platforms enable faster applications and underwriting, while customer relationship management( CRM) systems help agents manage prospects and clients more efficaciously.

Social media and digital marketing provide new prospect channels, though they require different skills than traditional face to face selling. Agents who embrace technology oftentimes gain competitive advantages through improved efficiency and broader reach.

Artificial intelligence and automated underwriting are streamline processes, potentially reduce the need for traditional agent involvement in simple cases. Nonetheless, complex cases and high net worth clients nonetheless require personal attention and expertise.

Build a sustainable client base

Successful agents develop systematic approaches to prospect and client acquisition. Referrals from satisfied clients provide the highest quality leads, make excellent service essential for long term success.

Network through professional associations, community organizations, and business groups create opportunities to meet potential clients and referral sources. Many agents specialize in specific markets or demographics to build expertise and recognition.

Regular client reviews and policy updates maintain relationships and create opportunities for additional sales. Agents who position themselves as trust advisors kinda than salespeople typically achieve better results and higher client retention.

Work-life balance and lifestyle considerations

Life insurance sales offer significant flexibility, with many agents set their own schedules and work from home offices. This autonomy appeals to professionals seek work-life balance or those with family commitments.

Nonetheless, the flexibility come with responsibility for self motivation and time management. Successful agents oftentimes work evenings and weekends to accommodate clients’ schedules, specially when meet with families.

Income variability can create stress, specially for new agents build their business. Financial planning and budgeting become crucial skills for manage irregular commission income.

Company culture and support systems

Insurance companies vary importantly in their support for new agents. Some provide extensive training programs, mentorship, and marketing support, while others offer minimal assistance beyond basic licensing requirements.

Source: slidebusiness.com

Research company culture, training programs, and support systems is crucial when choose an employer. Companies with strong training programs and ongoing support typically produce more successful agents.

Some organizations offer salary or draw programs for new agents, provide income stability during the initial business building phase. These programs oftentimes include specific production requirements and time limits.

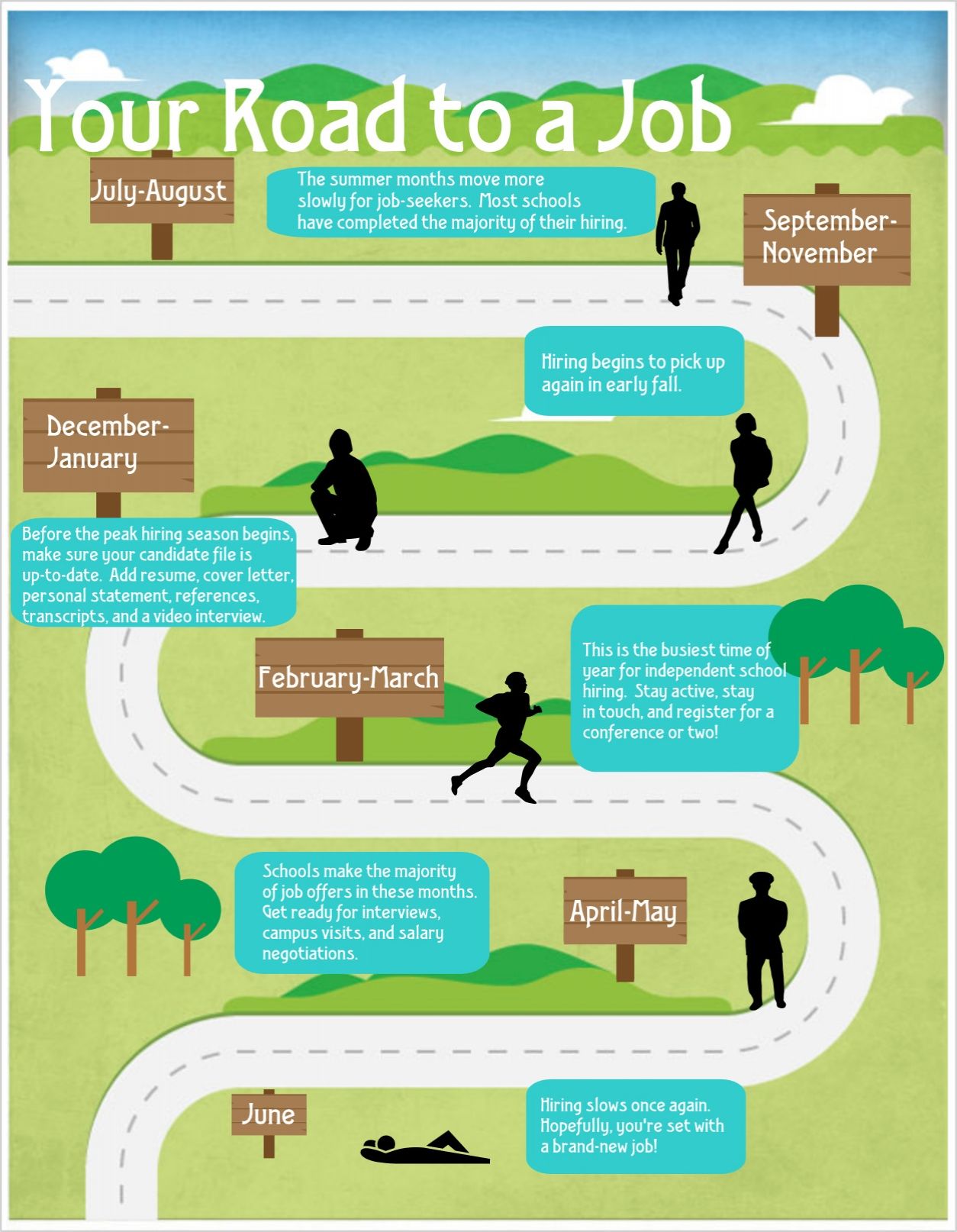

Market trends and future outlook

The life insurance industry continue to evolve, with increase focus on underserved markets and simplified products. Tgrowthrow awareness of life insurance needs among younger consumers create opportunities for agents who can efficaciously communicate with these demographics.

Workplace benefits are expanded to include voluntary life insurance options, create opportunities for agents specialize in group and worksite marketing. This channel frequentlprovidesde steady income and reduced prospecting requirements.

Economic uncertainty and market volatility increase consumer interest in guarantee products, potentially benefit life insurance sales. Agents who understand economic trends and can position insurance as financial protection may find increase receptivity to their message.

Make the career decision

Evaluate whether a life insurance career is right for you require honest self assessment. Consider your comfort with sales, ability to handle rejection, and willingness to work irregular hours to serve clients’ needs.

Financial stability during the startup phase is crucial, as most agents experience reduced income initially while build their business. Have adequate savings or alternative income sources can reduce stress and improve success chances.

The career reward those who truly care about help others and can maintain long term relationships. If you’re motivated by help families achieve financial security and can persist through challenges, life insurance offer excellent career potential.

Getting start in life insurance

Begin a life insurance career start with research potential employers and understand their training programs, compensation structures, and support systems. Interview with multiple companies to find the best fit for your goals and personality.

Obtain your license quickly and begin study product knowledge instantly. The more you understand about different policy types and their applications, the more confident and effective you’ll become in client interactions.

Develop a business plan include prospecting strategies, income goals, and professional development objectives. Successful agents treat their careers as businesses, invest in training, marketing, and relationship building to achieve long term success.

MORE FROM grabjobtoday.com